Alternative Payment Methods: A Growing Trend

The landscape of personal finance is rapidly evolving, and traditional credit cards are increasingly being challenged by a diverse array of alternative payment methods. This shift reflects a growing demand for greater financial flexibility, security, and convenience. Consumers are seeking options that cater to their specific needs and preferences, leading to a surge in popularity for digital wallets, mobile payments, and peer-to-peer (P2P) transfer systems. This diversification of payment choices is transforming how we interact with businesses and manage our personal finances.

Beyond the convenience factor, these alternative payment methods often offer advantages in terms of cost and control. Many services waive or reduce transaction fees compared to credit card processing, resulting in potential savings for both consumers and businesses. Additionally, the ability to track transactions in real-time and manage spending patterns effectively empowers users to make informed financial decisions.

The Rise of Digital Wallets and Mobile Payments

Digital wallets, such as Apple Pay and Google Pay, are becoming increasingly prevalent, facilitating seamless transactions through smartphones. These platforms often integrate with existing bank accounts, making it easier than ever to pay for goods and services, and often provide an enhanced level of security compared to traditional methods. This integration with mobile devices has revolutionized the way we engage with commerce, providing a level of convenience that was previously unimaginable.

The integration of digital wallets with loyalty programs and rewards systems is a significant development. Consumers can now accumulate points or rewards directly through their mobile payment platforms, enhancing the overall value proposition and encouraging greater adoption of these technologies. This integration offers a compelling reason for users to switch to alternative payment methods.

Peer-to-Peer (P2P) Transactions and Fintech Innovations

Peer-to-peer (P2P) payment platforms are gaining traction as a simple and efficient way to send and receive money. These platforms, such as Venmo and PayPal, often provide instant transactions, facilitating quick payments between friends, family, and even for business purposes. This ease of use, combined with the ability to track and manage transactions digitally, has made P2P payments a popular choice for many.

The emergence of fintech companies is further revolutionizing the payment industry. These innovators are developing innovative payment solutions, often with features tailored to specific needs, such as budgeting tools and investment opportunities, that can make financial management easier. This constant evolution of the fintech landscape suggests that the future of payments will be even more dynamic and impactful on our daily lives.

The Impact of AI and Machine Learning on Payment Security

The Rise of Intelligent Systems

Artificial intelligence (AI) and machine learning (ML) are rapidly transforming various sectors, from healthcare and finance to transportation and manufacturing. These technologies are enabling the development of intelligent systems capable of performing tasks that were previously exclusive to human intelligence. This advancement is leading to significant improvements in efficiency and productivity across industries. Their ability to analyze vast datasets and identify patterns is revolutionizing decision-making processes, leading to more informed and strategic choices.

The increasing accessibility of powerful computing resources and the availability of massive datasets have fueled the growth of AI and ML applications. This has allowed researchers and developers to build increasingly sophisticated models and algorithms, pushing the boundaries of what's possible. As a result, we're seeing a rise in applications that can automate complex processes, personalize experiences, and predict future outcomes with remarkable accuracy.

Transforming Industries with AI and Machine Learning

The impact of AI and ML extends beyond the realm of theoretical advancements. These technologies are driving significant changes in various industries, reshaping business models and creating new opportunities. In healthcare, AI-powered diagnostic tools are improving accuracy and speed, helping doctors make faster and more informed decisions. In finance, machine learning algorithms are used for fraud detection and risk assessment, enhancing security and optimizing investment strategies.

Furthermore, AI and ML are revolutionizing customer service experiences. Chatbots powered by AI are handling customer inquiries, providing support 24/7, and improving response times. This automation frees up human agents to focus on more complex issues, leading to a more efficient and personalized customer journey.

The applications of AI and ML are not limited to these specific examples. From self-driving cars to personalized recommendations, these technologies are permeating almost every aspect of our lives, promising a future where tasks are automated, and decisions are optimized.

Ethical Considerations and Future Implications

As AI and ML continue to evolve, it's crucial to address the ethical implications associated with their use. Issues such as data privacy, bias in algorithms, and job displacement need careful consideration. Implementing responsible AI practices is essential to ensure that these powerful technologies are used for the betterment of humanity.

The future of AI and ML promises exciting possibilities, but also significant challenges. The potential for widespread automation and the need to adapt to a changing job market are crucial considerations. Investing in education and reskilling initiatives is vital to ensure a smooth transition for individuals and society.

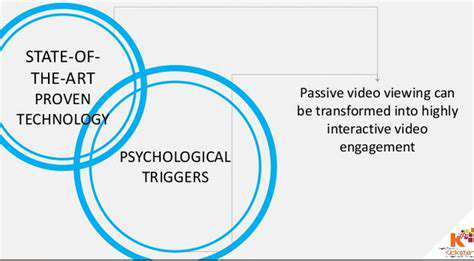

Immersive experiences are rapidly evolving, moving beyond simple entertainment to encompass a wide array of applications. From virtual reality (VR) simulations for training to interactive museum exhibits, these experiences are designed to transport users into a completely different world, fostering a deeper understanding and engagement with the subject matter. This shift towards immersive environments promises to revolutionize how we learn, interact, and experience the world around us. These experiences are not just passive observations but active participations, allowing users to explore and manipulate their surroundings in a way that traditional media simply cannot replicate.

The Future of Cross-Border Payments

The Rise of Real-Time Payments

The future of cross-border payments is inextricably linked to the increasing demand for real-time transactions. Businesses and consumers alike are demanding faster processing times, minimizing delays and maximizing efficiency. This necessitates a shift away from traditional, often cumbersome, international payment systems that can take days, or even weeks, for funds to transfer. Real-time payment systems, leveraging advanced technologies like blockchain and APIs, offer the potential to dramatically reduce these processing times, allowing for immediate settlement and improved cash flow for businesses engaging in cross-border e-commerce transactions. This speed is crucial for maintaining customer satisfaction and fostering trust in online marketplaces operating across international boundaries.

Innovative solutions are emerging to facilitate these real-time transactions. These solutions are designed to address the complexities of different currencies, regulations, and payment infrastructure across various countries. The development and adoption of these technologies will play a pivotal role in shaping the future landscape of cross-border payments, driving increased efficiency and accessibility for businesses looking to expand their operations into global markets. The impact on global commerce will be significant, as real-time payments unlock new opportunities for international trade and facilitate smoother transactions for consumers.

Enhanced Security and Compliance

Security and compliance are paramount concerns in the realm of cross-border payments, especially within the context of e-commerce. As online transactions become more frequent and global, the need for robust security protocols is heightened. Fraudulent activities and data breaches pose significant threats to both businesses and consumers. The future of cross-border payments must involve advanced security measures, including encryption technologies, multi-factor authentication, and sophisticated fraud detection systems to safeguard sensitive financial information. These measures are crucial for maintaining customer trust and confidence in online payment platforms.

Furthermore, evolving regulations and compliance requirements across different jurisdictions require meticulous attention. Businesses engaged in cross-border transactions must adhere to stringent regulations concerning data privacy, anti-money laundering (AML), and Know Your Customer (KYC) policies. The future of cross-border payments will demand greater transparency and accountability to ensure that transactions are conducted within the bounds of the law in each relevant jurisdiction. This necessitates the development of compliant payment systems that seamlessly integrate with evolving regulatory landscapes.

Robust security measures and strict compliance are vital to mitigating risk and fostering trust in the international e-commerce ecosystem, enabling seamless and secure cross-border transactions. The future of cross-border payments hinges on the integration of advanced security protocols with transparent and compliant practices.

By addressing the security and compliance needs proactively, businesses can ensure the integrity and reliability of their cross-border payment processes, contributing to the growth and stability of the global e-commerce market.

A critical component of this future involves the development of standardized security protocols and compliance frameworks that can be easily implemented and maintained across different countries and regions.

The Role of Central Bank Digital Currencies (CBDCs)

Understanding the Potential of CBDCs

Central Bank Digital Currencies (CBDCs) are digital representations of a nation's fiat currency, issued and regulated by the central bank. They offer a potential pathway for enhancing financial inclusion by providing a secure and accessible digital payment system. This technology could also improve the efficiency and speed of transactions, potentially lowering transaction costs and opening up new possibilities for innovation in the financial sector.

The potential for CBDCs to revolutionize the financial landscape is significant. Imagine a world where cross-border payments are instantaneous, low-cost, and secure, fostering global trade and economic growth. The ability to provide a more inclusive and accessible financial system, particularly in underserved communities, is another major benefit.

CBDCs and Financial Inclusion

One of the most compelling arguments for CBDCs centers around their potential to expand financial inclusion. Existing financial systems often exclude those without bank accounts or traditional access to financial services, particularly in developing countries. A CBDC could bypass these barriers, allowing individuals to participate in the digital economy and potentially empowering them financially.

This access is critical to economic development. By providing a readily available and secure digital payment solution, CBDCs could stimulate economic activity in regions currently underserved by traditional banking infrastructure, opening up opportunities for entrepreneurship and investment.

Security and Privacy Concerns

While the potential benefits of CBDCs are substantial, significant security and privacy concerns must be addressed. The digital nature of CBDCs makes them susceptible to cyberattacks, and robust security measures are essential to protect against fraud and theft. The potential for misuse, including money laundering and illicit financing, also requires careful consideration and mitigation strategies.

Ensuring privacy is paramount. The ability to trace transactions, especially in the context of financial surveillance, is a crucial aspect to consider. A balance between security and individual privacy needs to be carefully maintained to foster public trust and confidence in the system.

CBDCs and the Future of E-commerce

CBDCs could dramatically impact e-commerce by providing a faster, cheaper, and more secure payment method. Imagine the convenience of near-instantaneous transactions, eliminating the delays and fees associated with traditional payment systems. This could significantly boost e-commerce adoption and revenue generation, especially in international markets.

The reduced transaction costs could also encourage smaller businesses and entrepreneurs to embrace online platforms, opening up new opportunities for economic growth. This could facilitate a more inclusive and competitive online marketplace, benefitting both consumers and businesses.

Technical Challenges in Implementing CBDCs

Implementing a CBDC presents significant technical challenges. Developing the necessary infrastructure, including secure payment systems and robust digital platforms, requires significant investment and expertise. The integration of CBDCs with existing financial systems and technologies is crucial and presents a complex technical hurdle.

Interoperability with existing financial systems is vital to ensure a smooth transition and avoid creating fragmented financial ecosystems. Ensuring scalability and reliability of the system to handle a large volume of transactions is another essential aspect that needs careful consideration.

Impact on Monetary Policy

The introduction of a CBDC can significantly impact how central banks conduct monetary policy. It could potentially alter the relationship between central banks and commercial banks, shifting the balance of power in the financial system. The impact on inflation and interest rates also needs careful consideration, as the dynamics of the financial system will undergo a dramatic change.

Regulatory Frameworks for CBDCs

Establishing robust regulatory frameworks is critical for the successful implementation of CBDCs. Regulations must address security, privacy, and consumer protection, while also ensuring compliance with existing financial regulations. International cooperation and collaboration are essential to develop consistent and globally applicable standards.

These frameworks need to be adaptable to evolving technologies and challenges to ensure they remain effective in the long term. This adaptability is essential to maintaining public trust and confidence in the system.