The Regulatory Landscape for CBDCs

Governments play a crucial role in establishing the regulatory framework surrounding CBDCs. This framework must address key issues including consumer protection, financial stability, and anti-money laundering protocols. A robust regulatory environment ensures safe CBDC implementation, reduces risks, and builds public confidence. Clear guidelines for CBDC use across transactions, prevention of illegal activities, and protection of financial data are essential components.

Additionally, governments should collaborate internationally to set global CBDC standards. This coordination prevents inconsistencies and ensures cross-border compatibility. Standardization will facilitate CBDC integration into global finance, creating a more efficient international payments system.

Government Oversight and Supervision

Effective oversight maintains CBDC system integrity and stability. Independent monitoring bodies should assess performance, identify emerging risks, and enforce regulations. These entities require adequate resources to evaluate CBDC impacts on economies and financial markets, including effects on financial inclusion.

Government responsibilities include ensuring CBDC operational transparency and accountability. This involves establishing user communication channels, complaint resolution mechanisms, and performance reporting systems. Transparency fosters public trust and system confidence.

Financial Inclusion and Accessibility

Governments must guarantee CBDC accessibility for all societal segments. This includes integrating CBDCs with existing payment infrastructure, particularly in developing nations, to enhance financial inclusion. Collaboration with financial institutions to develop intuitive interfaces and simple onboarding processes is crucial, ensuring access isn't limited by technological or financial literacy barriers.

Promoting digital and financial literacy is vital for maximizing CBDC benefits. Governments should educate citizens on safe and effective CBDC use through educational materials, awareness campaigns, and partnerships with financial institutions. Widespread accessibility is key to achieving CBDC's full economic potential.

That fine, powdery blanket covering the Moon's surface isn't just a nuisance - it's a mission-critical challenge. What makes lunar dust so problematic is its uncanny ability to cling to everything it touches, from spacesuit fabrics to delicate scientific instruments. This clinginess stems from two key factors: the dust's microscopic size and its unique electrostatic properties. Unlike Earth dust, these particles have razor-sharp edges from billions of years of meteorite impacts without weathering.

The Future of E-commerce Payments: A Multifaceted Approach

The Rise of Buy Now, Pay Later (BNPL)

Buy Now, Pay Later (BNPL) services gain popularity in e-commerce by offering flexible payment options and attractive incentives. This flexibility particularly appeals to younger consumers, who prefer installment-based purchases with manageable payments. BNPL expands purchasing power and can encourage impulse buying.

However, BNPL proliferation raises concerns about overspending and debt accumulation, especially without careful account management. Responsible use and financial planning are crucial to avoid negative outcomes.

The Evolution of Mobile Payments

Mobile wallets and contactless payment methods grow increasingly sophisticated, providing seamless, secure e-commerce checkouts. This convenience boosts conversion rates by enabling quick, efficient purchases. Biometric authentication integration enhances security and reduces fraud risks.

The Growing Importance of Cryptocurrencies

Cryptocurrencies like Bitcoin and Ethereum gradually enter e-commerce payment systems. While adoption remains limited, their potential for faster, cheaper, and more secure transactions attracts business interest. Value volatility presents challenges, but the technology holds exciting e-commerce possibilities.

The Impact of AI on Payment Processing

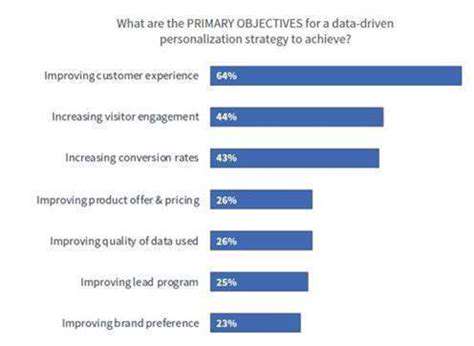

Artificial intelligence transforms e-commerce payment processing. AI systems detect fraudulent transactions with high accuracy, reducing business losses. AI algorithms also personalize payment suggestions based on customer purchase history and preferences, significantly improving user experience.

Security Enhancements and Fraud Prevention

E-commerce security remains paramount, with continuous innovation to protect customer data. Advanced encryption and multi-factor authentication become standard, offering robust cyber threat protection. Strong security measures maintain consumer trust in online shopping platforms, ensuring safer digital transactions for all users.

The Role of Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies (CBDCs) emerge as potential financial game-changers that could revolutionize e-commerce payments. CBDCs promise faster, cheaper transactions while preserving financial system stability. Widespread CBDC adoption could transform global e-commerce payments, creating a more efficient international transaction platform.

The Future of International Payments

As international e-commerce grows, demand increases for seamless, affordable cross-border payments. Innovative processing systems develop to address these needs, making global transactions more efficient. Fast, reliable international fund transfers across currencies will be essential for global e-commerce expansion, enabling businesses to reach wider customer bases worldwide.