Early Pioneers and Their Impact

The mobile payment revolution didn't happen overnight. Visionary companies saw the potential in transforming phones into payment tools long before it became mainstream. These trailblazers, often small startups with big dreams, tested different technologies that would eventually shape today's digital wallet landscape. Their early experiments, though sometimes doubted, proved mobile payments could work - paving the way for the systems we use daily.

Companies like Square and PayPal identified pain points in traditional payment methods. By blending mobile tech with existing payment systems, they created solutions that were both convenient and secure, making way for broader acceptance of digital transactions.

Technological Limitations of Early Systems

First-generation mobile payment solutions faced multiple technical challenges. Security worries topped the list, with early systems lacking the robust protections we expect today. Compatibility issues between different phones and platforms created headaches, while limited processing power constrained what these systems could do. The absence of strong encryption made many consumers and businesses understandably cautious about adopting these new payment methods.

Infrastructure Gaps and Consumer Resistance

Widespread adoption faced another hurdle: spotty network coverage. Many areas simply lacked the connectivity needed for reliable mobile transactions. Adding to the challenge was public skepticism - people needed convincing that paying by phone was safe and worthwhile. Overcoming these barriers required massive infrastructure investments and public education efforts.

Security Concerns and Data Privacy

In the early days, protecting financial data transmitted through phones kept developers awake at night. Without today's advanced security measures, the risk of fraud and data theft made many hesitant to embrace mobile payments. The breakthrough came with stronger encryption and more secure transaction processing methods.

The Rise of NFC and Near-Field Communication

Everything changed with NFC technology. This contactless innovation eliminated the need to swipe or insert cards, making payments faster and more convenient than ever. The simple tap-to-pay experience helped overcome initial user resistance and set new standards for mobile transactions.

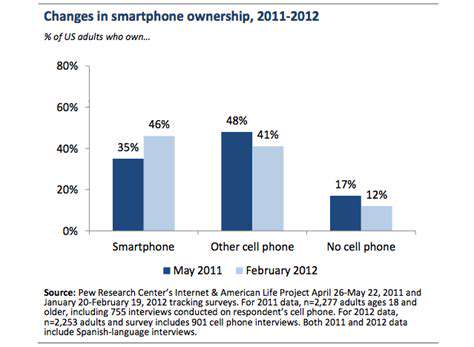

The Impact of Smartphone Proliferation

As smartphones became ubiquitous, mobile payments went mainstream. The combination of widespread phone ownership, better mobile internet, and user-friendly payment apps created perfect conditions for explosive growth. Suddenly, paying by phone wasn't just possible - it was often the easiest option.

The Evolution of Mobile Payment Standards

The development of universal standards like EMV marked a turning point. These protocols ensured different payment systems could work together securely, reducing fraud risks while improving reliability. As these standards continue evolving, they'll drive further innovation in mobile payments.

The Rise of Smartphones and the App Economy: Fueling the Revolution

The Impact on Communication

Smartphones have rewritten the rules of human connection. Instant messaging and video calls have made global communication effortless, collapsing distances between continents. While this constant connectivity offers tremendous benefits, it also brings challenges like information overload and the erosion of work-life boundaries.

Mobile messaging apps have transformed how we maintain relationships. The ability to instantly connect with anyone, anywhere has strengthened personal bonds while enabling unprecedented global collaboration.

The Transformation of Entertainment

Our phones have become portable entertainment centers. Streaming services have revolutionized media consumption, putting entire libraries of content at our fingertips. This convenience comes with potential downsides, including shortened attention spans and an expectation of constant stimulation.

Mobile gaming has grown into a cultural phenomenon. The ability to game anywhere has created new entertainment habits and spawned an entire industry built around smartphone gaming.

The Evolution of Productivity

Smartphones have redefined workplace efficiency. From scheduling to document editing, these devices put powerful tools in our pockets. While boosting productivity, this 24/7 accessibility can also lead to burnout as work increasingly invades personal time.

Financial management has never been more accessible. Mobile banking apps give users real-time control over their money, though this convenience requires heightened security awareness.

The Impact on Information Access

The sum of human knowledge now fits in our palms. Instant access to information has transformed how we learn, research, and make decisions. However, this firehose of data can overwhelm as easily as it informs.

News consumption has become instantaneous, creating a more engaged global citizenry. Yet this immediacy also amplifies challenges like misinformation and polarized viewpoints.

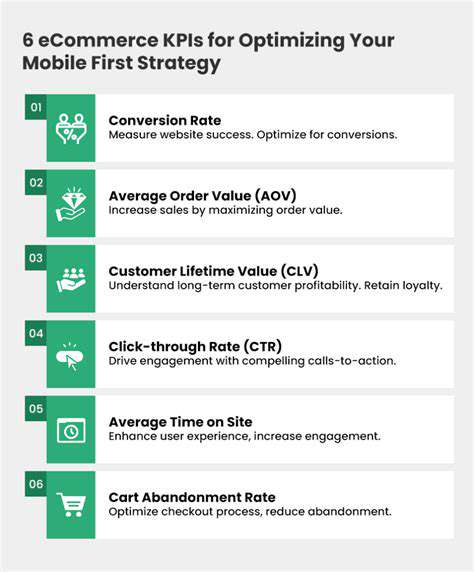

The Rise of Mobile Commerce

Shopping has undergone a digital revolution. Mobile payments have made transactions seamless, changing consumer behavior and forcing retailers to adapt. The convenience of buying anything anywhere has reshaped entire industries.

The Role in Social Interactions

Smartphones have redefined social connection. While enabling unprecedented global networking, they've also introduced new challenges to in-person interactions and mental wellbeing.

The Future of Smartphones

The next chapter promises even greater integration into our lives. Emerging technologies like AR and AI will further blur the lines between digital and physical worlds. As smartphones become even more central to healthcare, education, and daily living, their societal impact will only deepen.

Security and Privacy Concerns: Navigating the Digital Frontier

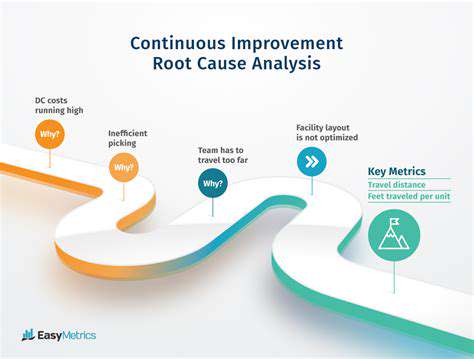

Data Security Measures

Protecting user information requires multiple layers of defense. Financial and personal data must be encrypted during transmission and storage using industry-leading protocols. Multi-factor authentication adds critical protection against unauthorized access.

Regular security testing identifies vulnerabilities before criminals can exploit them. Continuous monitoring of system activity allows for rapid detection and response to potential threats. Comprehensive security documentation ensures all team members understand their protective responsibilities.

Privacy Policies and Compliance

Clear, transparent privacy policies build essential trust. Users deserve straightforward explanations about how their data gets collected and used. Compliance with regulations like GDPR demonstrates commitment to user rights.

Giving users control over their information isn't just ethical - it's good business. Easy-to-use privacy controls and clear data handling procedures create safer digital environments.

User Authentication and Access Control

Strong authentication forms the first line of defense. Multi-factor verification and secure password practices significantly reduce unauthorized access risks. Regular protocol reviews ensure security measures evolve with emerging threats.

Third-Party Integrations and Security

Vetting external partners is crucial for maintaining security standards. Comprehensive assessments of third-party systems prevent vulnerabilities from entering through integrations. Secure communication channels protect data moving between systems.