Rising Complexity in Mobile Transactions

While mobile commerce continues its explosive growth, many businesses struggle with outdated checkout systems that frustrate users. Modern consumers demand frictionless experiences, yet mobile transactions often involve unnecessary hurdles. The root causes range from fragmented payment integrations to inconsistent device capabilities, creating a perfect storm of user frustration. Companies that fail to streamline their mobile checkout processes risk losing valuable customers to competitors with smoother systems.

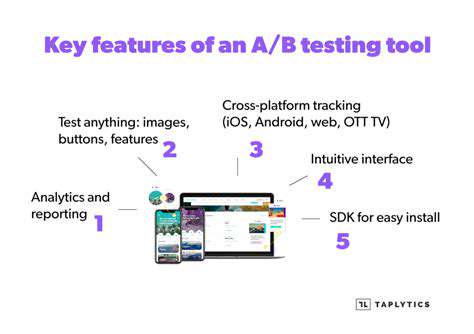

Today's device ecosystem presents unique challenges. With hundreds of screen sizes, operating system versions, and browser combinations, developers face an uphill battle to create consistent experiences. Thorough cross-platform testing becomes non-negotiable when aiming to serve all customers equally, regardless of whether they use the latest iPhone or a budget Android device from three years ago.

Balancing Security and Convenience

Security remains the cornerstone of digital transactions, especially for mobile commerce where risks multiply. Protecting sensitive financial data requires constant vigilance as new threats emerge daily. While payment innovations like biometric authentication offer convenience, they also introduce fresh security considerations. The most successful merchants implement layered security protocols that include end-to-end encryption and real-time fraud monitoring without creating checkout friction.

The payment method landscape continues evolving at breakneck speed. From digital wallets to cryptocurrency options, consumers expect merchants to support their preferred payment vehicles. This diversity forces businesses to maintain complex payment infrastructures while ensuring PCI compliance and seamless user experiences – a difficult balancing act requiring constant attention.

Optimizing for Conversion Success

Every step in the mobile checkout process impacts conversion rates. Well-designed flows can double conversion rates, while poor implementations drive customers away permanently. Key elements like progress indicators, autofill capabilities, and minimal form fields separate high-performing checkouts from abandoned carts. Merchants must view their checkout process through the customer's eyes, eliminating every possible point of friction.

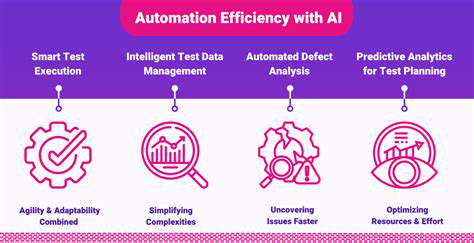

Performance metrics directly correlate with revenue. Pages that load in under two seconds see significantly higher completion rates than slower counterparts. Smart businesses invest in performance optimization, recognizing that milliseconds matter when impatient mobile users decide whether to complete purchases. Continuous A/B testing helps identify and eliminate bottlenecks that might otherwise go unnoticed.

Adopting Mobile-Centric Design Strategies

Core Principles of Mobile-First Methodology

The mobile-first philosophy revolutionizes digital design by prioritizing smaller screens before scaling to desktop. This approach forces designers to focus on essential functionality, resulting in cleaner interfaces that perform better across all devices. Companies adopting this methodology often see dramatic improvements in engagement metrics and conversion rates.

Starting with mobile constraints yields unexpected benefits. The limitations of smaller screens inspire creative solutions that often improve the desktop experience as well. Development teams appreciate how this approach reduces redundant work and creates more maintainable codebases that adapt gracefully to new device categories.

Crafting Intuitive Mobile Experiences

Exceptional mobile interfaces follow cognitive principles rather than aesthetic trends. Navigation patterns should feel instinctive, with critical actions remaining accessible regardless of device orientation. Successful designs account for thumb zones on various screen sizes, ensuring comfortable one-handed use for most consumers.

Building Adaptable Interface Systems

Modern responsive design goes beyond fluid grids. Truly adaptive interfaces modify not just layout but functionality based on device capabilities. A checkout process might offer NFC payments on capable devices while defaulting to traditional methods on others. This intelligent adaptation creates seamless experiences that customers appreciate.

Efficient Development Practices

The mobile-first approach naturally encourages lean development. Teams that build mobile foundations first often deliver projects faster while avoiding the bloat that plagues many desktop-first designs. This efficiency becomes increasingly valuable as businesses face pressure to iterate quickly in competitive markets.

Performance as a Priority

Mobile constraints force performance-conscious decisions that benefit all users. Techniques like lazy loading, optimized assets, and intelligent caching that originate from mobile optimization often improve desktop experiences as well. Pages that load quickly retain users better, making performance optimization a key revenue driver rather than just a technical consideration.

Strategic Content Presentation

Mobile screens demand ruthless editorial discipline. Content must deliver maximum value in minimal space, with visual elements supporting rather than competing with key messages. Well-optimized mobile content often performs better across all platforms, as the clarity forced by space constraints benefits desktop users as well.

Building Trust Through Robust Security Measures

Implementing Layered Authentication

Modern authentication systems combine multiple verification methods to protect accounts while minimizing user friction. Progressive authentication strategies that adjust security requirements based on risk factors provide optimal balance between security and convenience. For example, low-risk transactions might require simple biometric verification while high-value purchases trigger additional checks.

Advanced Data Protection Techniques

State-of-the-art encryption now extends beyond basic SSL implementations. Tokenization replaces sensitive data with non-sensitive equivalents throughout transaction processing, while homomorphic encryption allows certain computations on encrypted data. These advanced techniques create multiple security layers that protect customers even if other defenses fail.

Selecting and Integrating Payment Partners

Payment processor selection requires careful evaluation beyond basic functionality. The ideal partner offers not just robust APIs but also proactive fraud detection, chargeback management, and regulatory compliance expertise. Deep integration with these systems creates seamless yet secure checkout experiences that customers trust for repeat purchases.

Proactive Security Maintenance

Regular penetration testing and security audits should evaluate both technical vulnerabilities and human factors. Comprehensive testing regimens cover everything from API endpoints to social engineering susceptibility among customer service staff. The most secure systems combine automated monitoring with regular human review to catch evolving threats.