Understanding the Role of Stablecoins in E-commerce

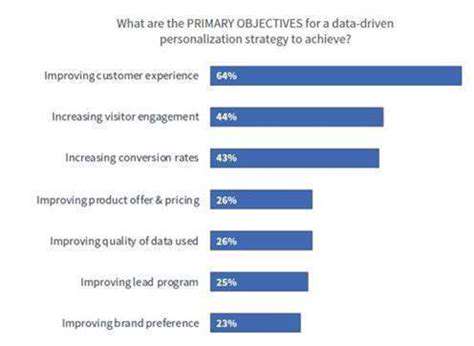

Stablecoins, designed to maintain a stable value pegged to a fiat currency like the US dollar, play a crucial role in bridging the gap between the volatile world of cryptocurrency and the more predictable realm of traditional finance. This characteristic makes them a potentially transformative force in e-commerce, offering a more stable and reliable payment method compared to fluctuating cryptocurrencies. Their use in e-commerce transactions could significantly reduce risk and enhance trust, leading to broader adoption of cryptocurrencies for online purchases. The potential for seamless integration with existing payment systems also makes stablecoins an appealing option for businesses seeking to expand their payment options.

By offering a consistent value, stablecoins can mitigate the price volatility often associated with cryptocurrencies. This stability is a key advantage for businesses and consumers alike, as it eliminates the risk of significant fluctuations in transaction values. Furthermore, the potential for faster and cheaper transactions, compared to traditional banking methods, makes stablecoins an attractive alternative for e-commerce businesses looking to streamline their payment processes and potentially reduce costs.

Stablecoin Integration: Benefits for Consumers and Businesses

For consumers, stablecoins provide a potentially lower-risk and potentially more efficient way to make online purchases. The reduced volatility compared to other cryptocurrencies minimizes the risk of significant price swings during transactions, offering a more predictable and stable purchasing experience. This increased stability can be particularly appealing for customers who are hesitant to embrace volatile cryptocurrencies for everyday transactions, potentially expanding the user base for e-commerce platforms that accept stablecoins.

Businesses, too, can benefit from integrating stablecoins into their payment systems. Stablecoins offer the potential for faster and cheaper cross-border transactions, potentially reducing costs associated with international payments. This advantage can be particularly significant for businesses operating in a global marketplace, enabling them to reach a wider customer base and expand their operations more efficiently. Moreover, the potential for greater transaction transparency, compared to traditional systems, can enhance trust and security, benefiting both businesses and customers alike.

The Future of E-commerce Payments with Stablecoins

The future of e-commerce payments is likely to be shaped by the increasing adoption of stablecoins. As technology continues to evolve and regulatory frameworks adapt, stablecoins could become a mainstream payment method, offering a more efficient, secure, and potentially less expensive alternative to traditional methods. The potential for cross-border payments and the reduction in transaction costs could lead to a more globalized and interconnected e-commerce landscape.

Several factors, including regulatory clarity, widespread adoption by e-commerce platforms, and consumer trust, will play a crucial role in the widespread adoption of stablecoins for e-commerce transactions. Ultimately, the integration of stablecoins into e-commerce could revolutionize the way we think about online payments, paving the way for a more inclusive and accessible digital economy.

Central Bank Digital Currencies (CBDCs): A Potential Game Changer?

Understanding CBDCs

Central Bank Digital Currencies (CBDCs) represent a digital form of a nation's fiat currency, issued and regulated by the central bank. Instead of relying on physical cash or commercial bank deposits, CBDCs exist solely in digital form, offering a direct relationship between the central bank and the public. This digital representation allows for potentially faster and cheaper transactions compared to traditional methods, and could offer greater efficiency and security in the financial system.

Potential Benefits of CBDCs

One key benefit of CBDCs is the potential for improved financial inclusion. They can provide access to financial services for unbanked and underbanked populations, particularly in developing countries, who may not have access to traditional banking infrastructure. Additionally, CBDCs can enhance the efficiency of payments, potentially reducing transaction costs and speeding up settlements. This is particularly important for international trade and remittances, where efficiency can translate to significant savings.

Technological Considerations

Implementing a CBDC requires robust and secure technological infrastructure. This includes ensuring the security of the digital ledger and the protection against cyber threats. Furthermore, the design and development of a CBDC must consider its potential impact on existing financial systems and institutions, as well as the need for interoperability with other digital payment systems.

Privacy and Security Concerns

While CBDCs offer potential benefits, privacy and security concerns are paramount. The digital nature of a CBDC means that every transaction is recorded on a ledger, raising concerns about the potential for surveillance and the misuse of personal financial data. Robust security measures are essential to prevent fraudulent activities and unauthorized access to individual accounts. These issues need careful consideration and appropriate safeguards to mitigate these potential risks.

Impact on Financial Institutions

The introduction of a CBDC could significantly impact existing financial institutions. Traditional banks may need to adapt to a new landscape where a central bank digital currency competes directly with their services. This could lead to a restructuring of the financial sector, potentially requiring banks to innovate and develop new services to remain competitive in the digital age. It is essential to consider the implications for the financial industry as a whole, ensuring a smooth transition and minimizing disruption.

International Implications and Regulations

The adoption of CBDCs by one country can have far-reaching international implications. Harmonization of regulations across borders will be crucial to avoid fragmentation and ensure that CBDCs do not create new obstacles to international trade and commerce. International collaboration and standardization of protocols are essential for the seamless functioning of CBDCs in a globalized world. The regulatory landscape for CBDCs will need careful consideration and thoughtful development to ensure global stability and cooperation.

The Regulatory Landscape: Shaping the Future of Digital Payments

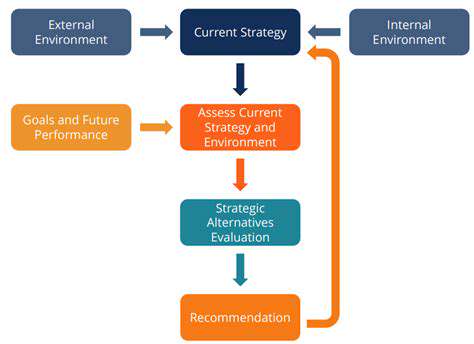

Navigating the Complexities of Regulatory Frameworks

The regulatory landscape for businesses is a constantly evolving maze, demanding a deep understanding of various laws, guidelines, and regulations. Companies must meticulously navigate these complexities to ensure compliance and avoid costly penalties. Staying ahead of regulatory changes is crucial for maintaining a competitive edge, and proactive monitoring is essential. Understanding the specific regulations applicable to a company's industry and geographical location is paramount.

Numerous agencies and governing bodies contribute to the regulatory framework, each with its own set of rules and procedures. Businesses must be familiar with these various entities and their respective mandates. Failure to comply can result in significant repercussions, from fines and legal action to damage to the company's reputation and brand image.

The Impact of Industry-Specific Regulations

Different industries face unique sets of regulations, each tailored to address specific risks and concerns. The pharmaceutical industry, for example, has stringent regulations concerning drug safety and efficacy, while the financial sector is governed by complex rules pertaining to financial stability and consumer protection. Understanding these industry-specific regulations is essential for effective risk management.

These specialized regulations are often designed to protect consumers and maintain public safety. A thorough understanding of these rules is vital for businesses operating within these regulated industries. Failure to comply with industry-specific regulations can result in severe consequences, including operational disruptions, financial penalties, and even criminal charges.

International Regulations and Global Trade

In today's interconnected global marketplace, businesses must contend with international regulations that often differ significantly from domestic laws. Navigating these cross-border complexities can be challenging, requiring specialized knowledge and expertise. International trade agreements and tariffs are critical factors to consider, and a comprehensive understanding of these elements is essential for success in international markets.

Compliance with international regulations is often crucial for market access and expansion. A failure to adhere to these standards can result in trade restrictions, penalties, and significant disruptions to business operations. Businesses must adapt to the ever-changing landscape of international trade regulations.

The Role of Regulatory Compliance in Business Operations

Effective regulatory compliance is not merely a legal obligation; it's a cornerstone of successful business operations. A robust compliance program fosters trust with stakeholders, including customers, investors, and the community. A strong compliance framework can also enhance a company's reputation and brand image.

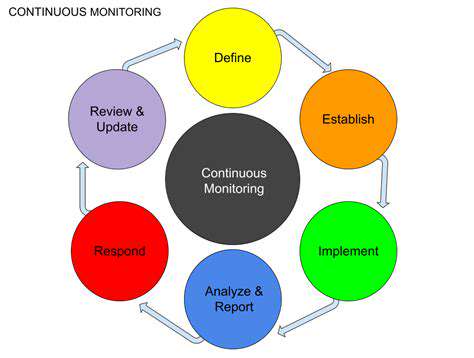

Implementing a comprehensive compliance program requires dedicated resources, including trained personnel and appropriate technology. This ensures that all relevant regulations are understood and adhered to. This comprehensive approach fosters efficiency and reduces the risk of legal issues. Regular audits and reviews are crucial to ensure ongoing compliance.

Emerging Trends and Future Challenges

The regulatory landscape is constantly evolving, with new technologies and global challenges emerging. The rise of artificial intelligence, for instance, presents novel regulatory challenges concerning data privacy, algorithmic bias, and ethical considerations. These emerging trends necessitate a proactive approach to regulatory adaptation.

Staying informed about these emerging trends is critical for businesses to anticipate and address future challenges. Adapting to these shifts requires continuous learning, collaboration, and a flexible approach to compliance strategies.