The Future of Omnichannel Payments: A Personalized Experience

The Rise of Seamless Integration

Omnichannel payments are evolving beyond simply allowing customers to make purchases across various platforms. The future hinges on a truly seamless integration, where the customer journey feels unified and frictionless, regardless of the channel they choose. This means a single, consistent customer experience that anticipates their needs and preferences, guiding them effortlessly through the payment process.

Imagine a world where a customer can start a purchase on their phone, seamlessly transition to a desktop for a more detailed review, and complete the transaction in-store without any hiccups. This seamless transition will be crucial in attracting and retaining customers in a rapidly changing market.

Enhanced Security Measures

As omnichannel payments become more prevalent, so too will the need for robust security measures. Modern payment systems must incorporate advanced fraud detection algorithms and encryption protocols to safeguard sensitive customer data. Protecting customer information is paramount and will be a key differentiator for businesses.

Furthermore, biometrics and multi-factor authentication will play an increasingly important role in verifying customer identities and preventing unauthorized transactions, ensuring a safe and secure omnichannel experience.

Personalization and AI Integration

AI and machine learning are poised to revolutionize omnichannel payments by providing highly personalized experiences. These technologies can analyze customer behavior and preferences to offer tailored payment options and recommendations, ultimately enhancing customer satisfaction and loyalty.

AI-powered chatbots can offer instant support, answer queries, and even guide customers through the payment process, creating a more interactive and efficient experience. This level of personalization will be essential for businesses to stand out in a competitive market.

Mobile-First Approach

The mobile-first approach in omnichannel payments is already gaining traction and will likely continue to dominate. Mobile devices offer unparalleled convenience, allowing customers to make payments on the go, anytime, anywhere. This accessibility is crucial for a modern omnichannel strategy.

Mobile wallets, QR codes, and other mobile-payment solutions are becoming increasingly sophisticated and user-friendly. The trend will continue to drive the evolution of omnichannel payments.

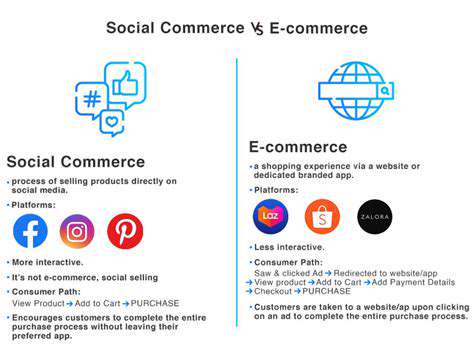

The Impact on Retail and E-commerce

Omnichannel payments are transforming the retail and e-commerce landscape. Businesses are finding new ways to engage customers and provide value through seamless experiences across various touchpoints.

This integrated approach allows businesses to collect valuable data about customer preferences and behavior, enabling them to personalize offerings and improve customer satisfaction. E-commerce platforms that embrace omnichannel payment capabilities will gain a significant advantage.

Emerging Payment Technologies

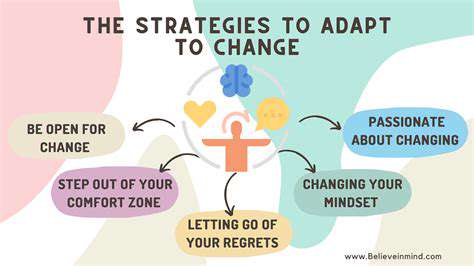

The future of omnichannel payments is intertwined with the emergence of innovative payment technologies. From blockchain-based solutions for enhanced security to cryptocurrencies for cross-border transactions, new methods are constantly being developed.

These emerging technologies have the potential to revolutionize the payment landscape, creating more efficient and secure systems for businesses and consumers. The adoption of these technologies will be crucial for businesses looking to stay ahead of the curve.

The Customer Experience

Ultimately, the future of omnichannel payments revolves around creating an exceptional customer experience. Focusing on ease of use, security, and personalization will be critical for success. Customers expect seamless transactions, regardless of the channel they use.

Businesses that prioritize a positive customer experience will be best positioned to thrive in the evolving omnichannel landscape, building lasting relationships and fostering customer loyalty.